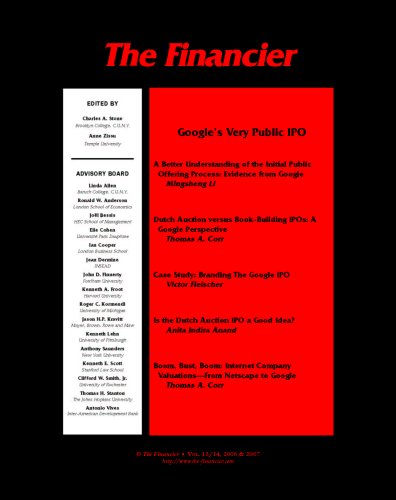

Google Inc. (Google) is a California based internet search engine company that was formed in 1998 by Stanford University PhD students Larry Page and Sergey Brin. On April 19, 2004 Google filed Form S-1 Registration Statement (S-1) with the U.S. Securities and Exchange Commission indicating its intent to go public by an Initial Public Offering (IPO) of its shares. In a July 27, 2004 regulatory filing with the SEC, Google announced that it planned to sell the shares using the Dutch auction method. Prior to the IPO, valuations from industry experts and Google itself suggested that the IPO would place a value on Google in a range of $8.3 billion - $57 billion. The purpose of this paper is to address the Dutch auction versus Book-building IPO methodologies, the results of the Google IPO, and the effect of the Dutch IPO process on the Google IPO. (Excerpt from paper by Tom Corr published in the book)************** This Case Study discusses the branding impact of the Google IPO. In a longer, Article-length version of this paper which appears in the Michigan Law Review, I argue that branding is an unappreciated element of contract design. Corporate finance scholars generally assume that consumers focus on product attributes like price, quality, durability, and resale value. But consumers choose brands, not just attributes. The legal infrastructure of deals sometimes affects the brand image of the company. This Case Study explores the link between deal structure and brand image in one specific but noteworthy deal, the Google IPO. It is an extreme example of the branding impact of deal structure, but one that helpfully demonstrates the branding implications that exist, to a lesser degree, in other deals. The primary goal of structuring an IPO is to lower the cost of capital by managing the information asymmetry between the issuer and investors. From this perspective, the success of the Google deal is questionable. Few would call the deal elegant or efficient. But the auction structure allowed Google to do more than raise money. Google also reinforced its image as an innovative, egalitarian, playful, trustworthy company. (excerpt from Victor Fleischer's paper)

Authors